37+ pay off mortgage with 401k cares act

Web The new CARES Act increases the potential size of loans from 401 k-style plans to a maximum of 100000 from 50000 before. Web One provision from The CARES Act allows investors of any age to withdraw as much as 100000 from retirement accounts including 401 k plans and individual.

Dave Ramsey S Early Mortgage Pay Off Advice Good Idea

Web If an employer allows plan loans the Cares Act has increased the limit on loans to 100000 from 50000.

. Web CARES Act Mortgage Forbearance. In the past you have been allowed to borrow up to 50 of your account balance or 50000 whichever is less. Web For example the act eased limits on early distributions from tax-advantaged retirement accounts and also increasing the amount people could borrow from their.

What You Need to Know UPDATE. Increasing Mortgage Payments Could Help You Save on Interest. Web The CARES Act is making changes there too.

But this increase isnt automatic. Web Through the CARES Act you have the right to request forbearance for up to 180 days with the possibility of another 180 days if youre still under financial distress. Web The CARES Act provides that qualified individuals may treat as coronavirus-related distributions up to 100000 in distributions made from their eligible retirement.

Web The Cares Act has waived the rule that limits retirement plan participants to only borrowing up to 50 percent of their fully vested balance or up to 50000 whichever. And payments new and existing can be deferred. Web Under 401a31A if a distributee elects to have an eligible rollover distribution paid directly to an eligible retirement plan and specifies the eligible retirement plan to receive.

View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. The CARES act affects retirement accounts such as 401 k accounts by lifting penalties for early withdrawal. Since this video was released federal regulators have made it clear that if you receive a forbearance.

Web The CARES Act permits workers to take up to 100000 in hardship distributions from their workplace retirement accounts without a 10 early withdrawal. Web What The CARES Act 401K Withdrawal Affects. Web Cashing out your 401 k and using the proceeds to pay off your mortgage lets you borrow at a low rate and invest at a high rate and do so at no risk.

Leesburg Today June 5 2014 By Insidenova Issuu

:max_bytes(150000):strip_icc()/GettyImages-534599661-42322be5b1f047229707b9f8bbce84b5.jpg)

Using Your 401 K To Pay Off A Mortgage

The Union Democrat 07 01 2015 By Union Democrat Issuu

Personal Finance Apex Cpe

4 18 2013 Ramona Sentinel By Utcp Issuu

Coronavirus 401 K Withdrawal Stimulus Package Rules Moneygeek Com

Should I Use My 401 K To Pay Off My Mortgage 5 Things To Consider Principal Com

Why Are At T Retiree Medical Costs So High Cwa Local 4034

Should You Pay Off Your Mortgage Before You Retire Credible

Should I Use My 401 K To Pay Off My Mortgage 5 Things To Consider Principal Com

Retirement Changes Due To The Cares Act

Coronavirus 401 K Withdrawal Stimulus Package Rules Moneygeek Com

Cares Act Relief For Retirement Plan Loan Payments Is Ending Now What

Given Current Rates Could Cashing Out Your 401 K To Pay Off Your Mortgage Make You A Bundle

How To Pay Off A 401k Loan Early The Budget Diet

The Union Democrat 08 04 2015 By Union Democrat Issuu

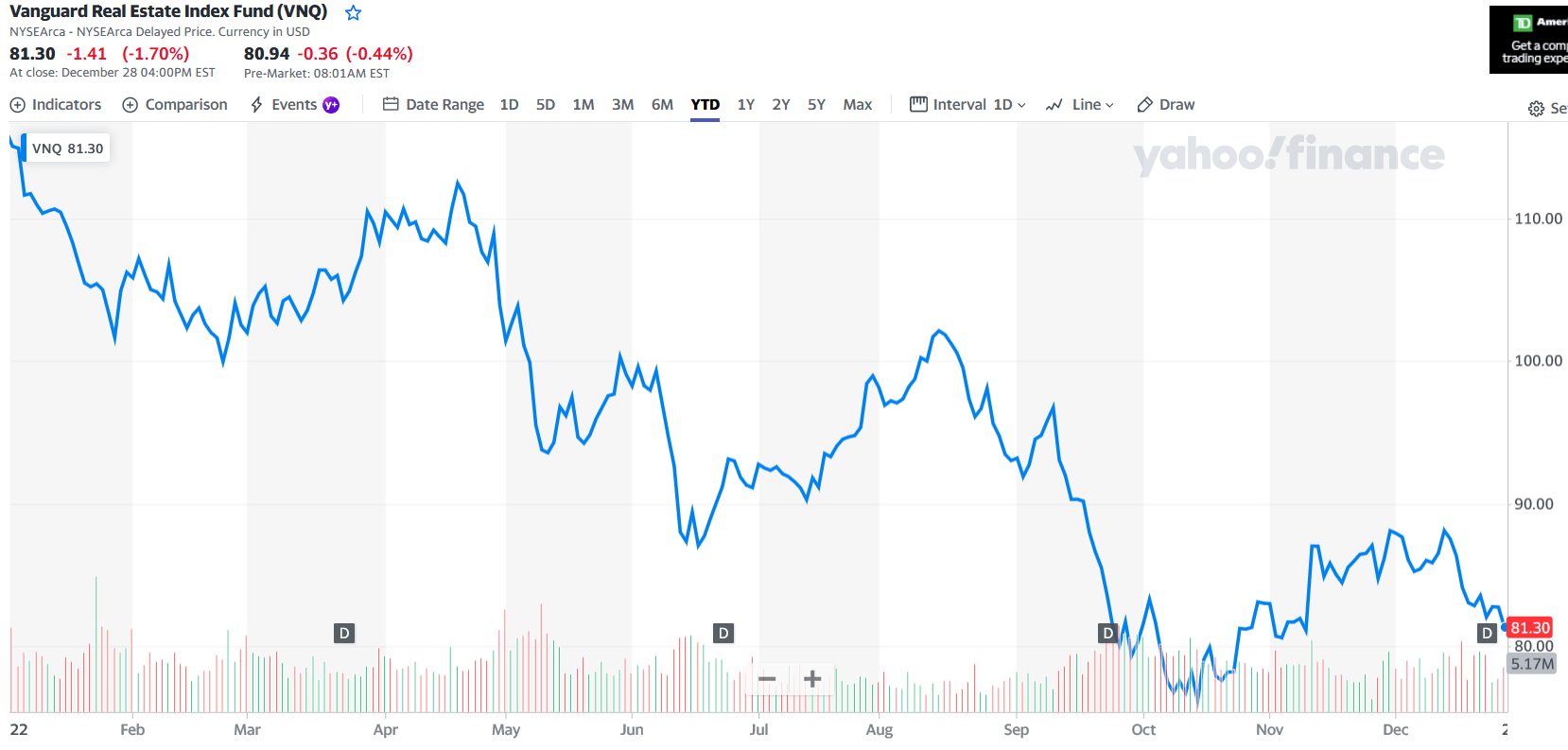

My Biggest Reit Losers In 2022 Seeking Alpha