What is the most you can borrow for a mortgage

There are up to 200000 so-called mortgage prisoners trapped in their current mortgage deal. That means extending the loan term.

As A First Time Home Buyer How Much Can I Borrow Wmc

Usually banks and building societies will offer up to four-and-a-half times the annual income of you and anyone you are buying with.

. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you can borrow. The HUD reverse mortgage loan to value ratio depends on the borrowers age the current interest rate and the value of the home. You can take a 100 percent mortgage if youre looking to secure a home loan without making a deposit.

Your salary will have a big impact on the amount you can borrow for a mortgage. In a few exceptional cases you might be able to borrow as much as 6 times your annual income. Find the lowest interest rate available to you.

If you still owe 200000 on your mortgage you could take about 40000. Interest rates are also a consideration and in most cases mortgage lenders will ensure you will still be able to repay the amount you borrow if interest rates were to increase. Comparison rates above are based on a home loan of 150000 for 25 years.

If the value of your home is 300000 and the lenders maximum LTV for a cash-out refinance is 80 the biggest mortgage you likely could qualify for would be 240000. For 2019 the maximum reverse mortgage loan amount is 726525. No small amount of money to save.

A break-even period of 25 months is fine and 50 might be too but 75 months is too long. This mortgage borrowing calculator is designed to give you a quick idea of the likely mortgage amount you can borrow based on your perceived affordability. If you cant afford your stamp duty bill then you do have the option to borrow more on your mortgage to cover the tax bill.

How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income. While every mortgage lender has their own criteria for determining how much you can borrow they all look at the following key factors when calculating a buy to let mortgage. This mortgage finances the entire propertys cost which makes an appealing option.

The general rule of thumb with mortgages is that you can borrow a mortgage that costs up to two and a half 25 times your annual gross income. Whether or not youve found a property to purchase you can come to our mortgage brokers to secure an Agreement in Principle AIP. Just enter your income debts and some other information to get.

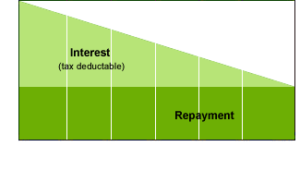

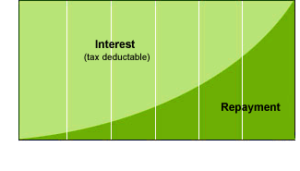

Paying 500 a month over 25 years means you are paying back 150000 but your mortgage will also include interest - which is charged per. It will also increase the number of lenders available to you which means a better. You can borrow a minimum of 5 and a maximum of 20 40 in London of the propertys full price.

Read unique story pieces columns written by editors and columnists at National Post. If you do borrow more you could end up with two loans. This means if youre buying alone and earn 30000 a year you could be offered up to 135000.

In some markets you will be hard-pressed to find a home for less than 500000. Just be aware that youll pay interest on that extra borrowing which over the average 25-year term of a. April 13 2022 If you are buying a home you know how expensive it can be.

Always educate yourself on the basics of unsecured personal loans and find out the amount range you will be able to borrow. This calculator provides useful guidance but it should be seen as giving a rule-of-thumb result only. Find out how much you can afford to borrow with NerdWallets mortgage calculator.

Ultimately your maximum mortgage eligibility is calculated by weighing your income against your debts purchase price of the house your down payment the mortgages interest rate as well as. Each drop lowers your monthly payment and means you can afford to borrow more or borrow the same amount and have a lower mortgage payment each month. You can expect a smaller bill if you increase the number of years youre paying the mortgage.

In a 200000 home this is 40000. Find out what you can borrow. While you wont pay any taxes penalty or interest if you borrow from your IRA and then return the money in full within 60 days you need to be extremely careful.

Can You Borrow From Life Insurance to Buy a Home. As a requirement you must. For a firmer idea its best to speak to an adviser who can run through.

If you move to a more expensive property as many people do if theyre looking for a bigger home you may need to borrow additional cash. You simply need to calculate how much stamp duty you will owe and increase your mortgage borrowing to cover it. Theres a good chance you will refinance again or sell your home in the next 625 years.

But the opposite is true when mortgage. If youre looking to maximise how much you can borrow however a larger deposit can go a long way towards persuading lenders that youre a safe bet. However this amount is subject to lots of different things such as your credit history monthly outgoings and deposit.

Avoid private mortgage insurance. If you cant move away from your existing mortgage deal. Different terms fees or loan amounts might result in a different comparison rate.

Or 4 times your joint income if youre applying for a mortgage. When you put at least 20 down on a conventional loan or 20 home equity on a refinance you can avoid paying monthly private mortgage insurance premiums PMI. Our mortgage calculators can give you a rough idea of how much you could borrow for your mortgage by taking the above factors into consideration.

Get in-depth analysis on current news happenings and headlines. For example a 15-year mortgage will have higher monthly payments than a 30-year mortgage loan because youre paying the loan off in a compressed amount of time. Most mortgage lenders will consider lending 4 or 45 times a borrowers income so long as you meet their affordability criteriaIn some cases we could find lenders willing to go up to 5 times income.

Important legal stuff. A standard mortgage requires a 20 down payment. How much mortgage can you borrow on your salary.

This will give you a solid idea. The comparison rates are true for the example given only and may not include all fees and charges. If you have decided that the best route for you financially is getting an unsecured loan then there are several steps you should follow during the process.

There are exceptions to this however. What mortgage can I get for 500 a month in the UK. Larger loans also known as jumbo.

Mortgage Calculator Netherlands 2022 Abn Amro

Infographic 10 Steps To Buying A Home In The Uk Home Buying Infographic 10 Things

How Much Money Can I Borrow Heritage Bank

Steps To Buying A House Buying First Home Home Buying Tips Home Buying

Pin By Tamara Torkelsen New American On Tamara Torkelsen Gateway Mortgage Group First Home Buyer Mortgage Brokers The Borrowers

7 Questions Answered About Getting A Dutch Mortgage In 2022 Dutchreview

The Most Affordable Places Where Buyers Can Still Find A Home For Sale Mortgage Rates Real Estate Information Real Estate Tips

How To Increase The Amount You Can Borrow My Simple Mortgage

Know The Cost Of Waiting Or In Some Cases The Cost Of Procrastinating Interoolympics Visit Buyo Real Estate Advice Real Estate Infographic Selling Real Estate

Pin On Finance Infographics

Pin On Data Vis

3 Types Of Personal Loans In Canada To Look In 2021 Personal Loans Loan Financial Planning

7 Questions Answered About Getting A Dutch Mortgage In 2022 Dutchreview

Lvr Calculator Or Loan To Value Ratio Will Work Out The Amount You Borrow It Is The Value Of A Property Used As Security I Lenders Mortgage Mortgage Brokers

5 Things Not To Do During The Mortgage Process It Doesn T Mean You Definitely Won T Get Approved For The Loan But Informative Mortgage Process How To Apply

Your Money Will Be Worth Less In The Future Whenever You Borrow Money And Have To Pay It Back L Paying Off Mortgage Faster Mortgage Payoff Preapproved Mortgage

Use The Interactive Home Loan Calculator To Calculate Your Home Loan Emi Mortgage Amortization Calculator Mortgage Loan Originator Mortgage Payment Calculator